The US presidential election is less than a year away. On November 5, 2024 voters will either reelect a Democratic president or switch to a Republican. As odd as this may seem, America’s presidency has been governed by only two parties for over 150 years.

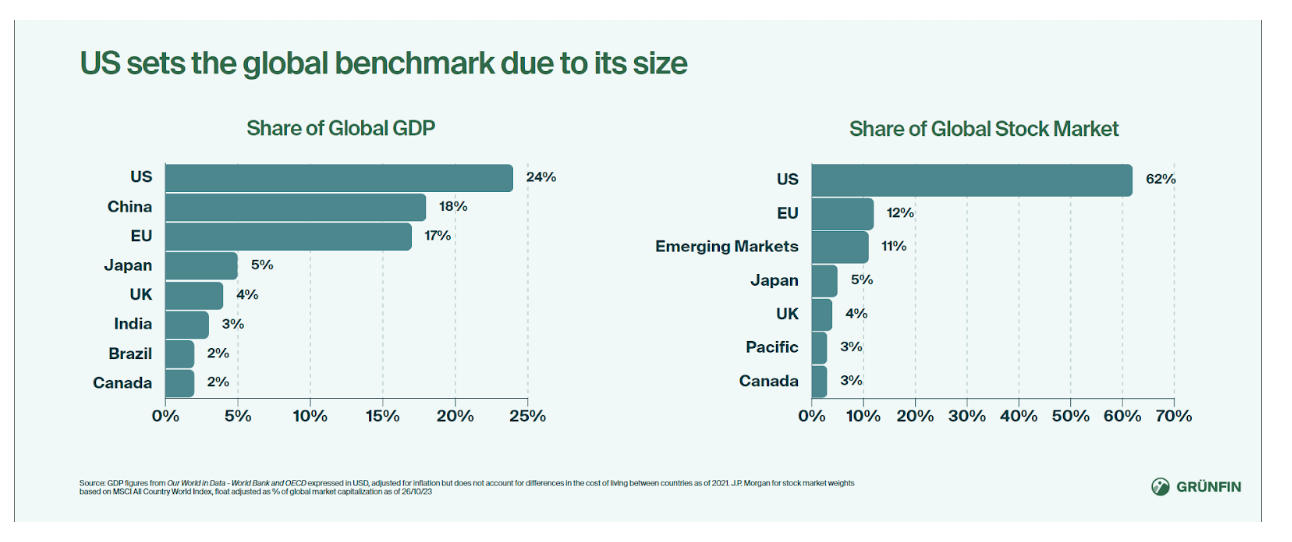

As the world’s largest economy and stock market, it’s worth analyzing how US elections have historically affected the country’s stock market.

As of now, the Democratic nominee is President Joe Biden running for reelection.

Biden turns 82 years old next year, so there’s a growing wave of Democrats urging him to step down in exchange for someone younger. A recent CNN poll shows only 51% of Democrats say Biden has the sharpness and stamina to serve as president.

The Republicans have several nominees, but former President Donald Trump is currently dominating his party’s race with a lead of 60 percentage points. Trump turns 78 years old, but roughly 90% of Republicans believe he has the sharpness and stamina to be president.

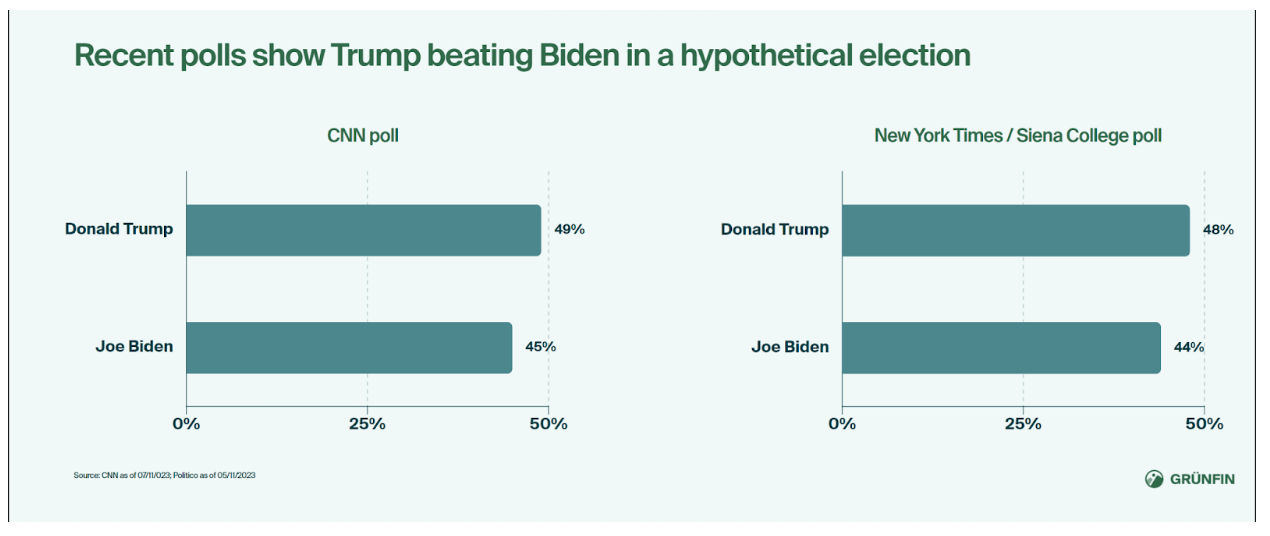

Recent polls by CNN and New York Times / Siena found Trump beating Biden in a hypothetical race.

Only 14% of Americans believe they are better off financially with Biden, citing inflation as their main concern, according to the Financial Times. This low approval is despite record job growth, strong GDP numbers and inflation lowered to 3,7%.

However, don’t discard Biden yet. History has been favorable to presidents running for reelection, winning roughly 75% of the time since 1912. Exceptions occur when recessions happen within two years before the election. The last election in 2020 was such a case when COVID led to a falling economy and Trump’s defeat.

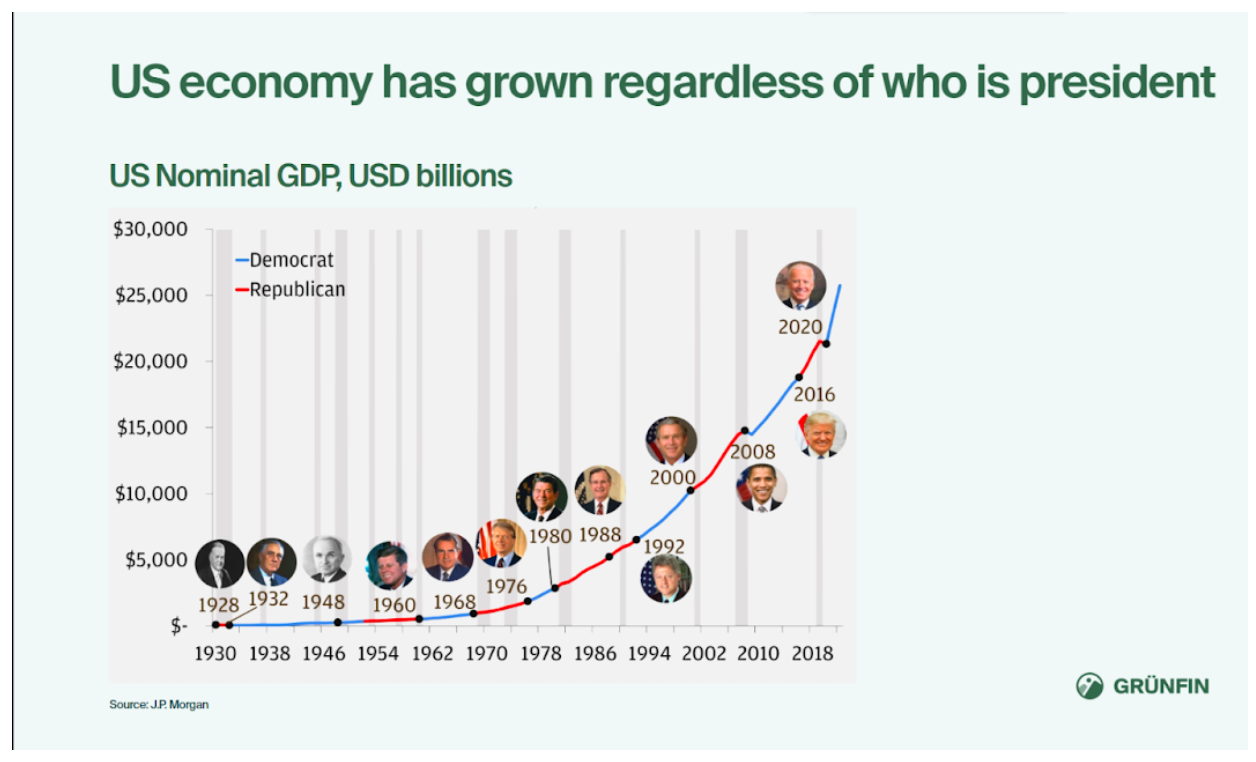

Anything can happen in politics in one year and polls could be wrong, but we do know one thing: the US economy and stock market have consistently grown under both Democratic and Republican presidencies.

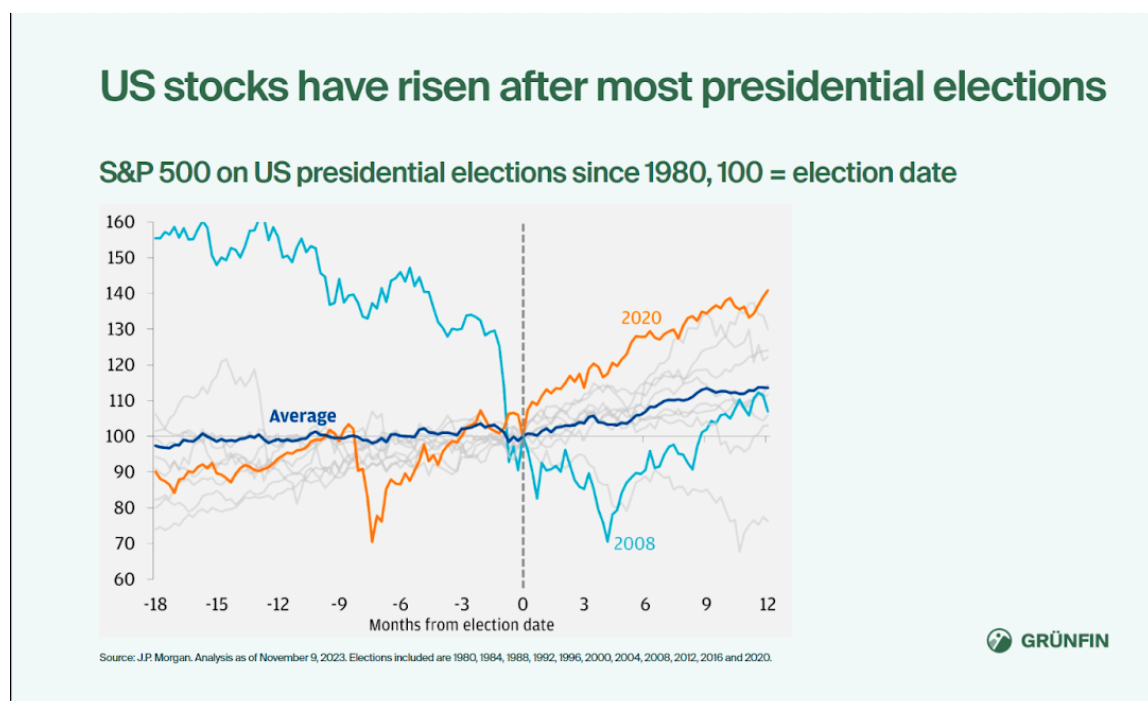

The S&P 500 has on average done well after elections regardless of presidential party.

We highlight two outliers in the chart above, 2008 on the downside and 2020 on the upside. In both instances the Democrats won the presidency. However, in 2008 the world was suffering from the worst economic crisis in nearly 80 years, while in 2020 there was euphoria after the COVID economic shock. In both cases, for bad or good, it wasn’t the presidential party that mattered; it was the economy.

If Biden or another Democrat wins, we expect continuity in major government policies like the push towards greener sources of energy, reduction in medicine prices, restriction of tech exports to China and higher antitrust regulation in sectors like healthcare and tech.

If Trump wins, we expect many of Biden’s key policies to reverse. Trump did exactly this when he took over from President Obama in 2016 by reversing elements of Obamacare, withdrawing from the Iran Nuclear Deal and exiting the Paris Climate Agreement.

The Paris Agreement is the most global and ambitious climate treaty ever enacted. It was adopted by nearly 200 countries with one key goal: to lower greenhouse gas emissions to net zero by 2050 to control global warming.

The US joined the climate agreement with Obama, exited with Trump and rejoined with Biden.

In 2017, major companies signed an open letter urging Trump to remain in the Paris Agreement. Some of the signatories were giants like Apple, Microsoft and Google.

Even if Trump were to exit the agreement again, we believe most companies would continue on their journey to net zero emissions. These corporations are way too far ahead in their commitments, operations and promises to shareholders at this point. Moreover, the European Union, China and India remain in the Paris Agreement. Therefore, global companies would still need to follow the climate regulations of the treaty in these jurisdictions.

In conclusion, the US economy and stock market have grown regardless of which political party holds the presidency. When it comes to the Paris Agreement, we are confident companies will continue on their journey to net zero emissions regardless of US policy.

These could also be interesting to you

Quaterly news from Grünfin 2024 Q2

Quarterly updates about the financial markets, news, and your portfolio performance.

Quaterly news from Grünfin 2024 Q1

Grünfin quaterly news about financial markets and Grünfin sustainable portfolios.

Sustainability's highest standard. Grünfin is now a B-Corp

Certified B Corporations, or B Corps, are companies verified by B Lab, third party, to meet high standards of social and environmental performance, transparency, and accountability.