We’ll help you better understand the meaning and mechanics of the green bond market.

What are green bonds? Explained with examples

We recently went over regular bonds and how they work.

Green bonds operate pretty much the same way, but specifically finance projects with direct environmental benefits.

Examples of projects are:

- Solar, wind and hydro energy (You can find Vestas wind Turbines in your Climate portfolio),

- Transportation like railroads and electric vehicle infrastructure,

- Energy efficient buildings,

- Recycling facilities,

- Sustainable water sourcing and

- Nature restoration.

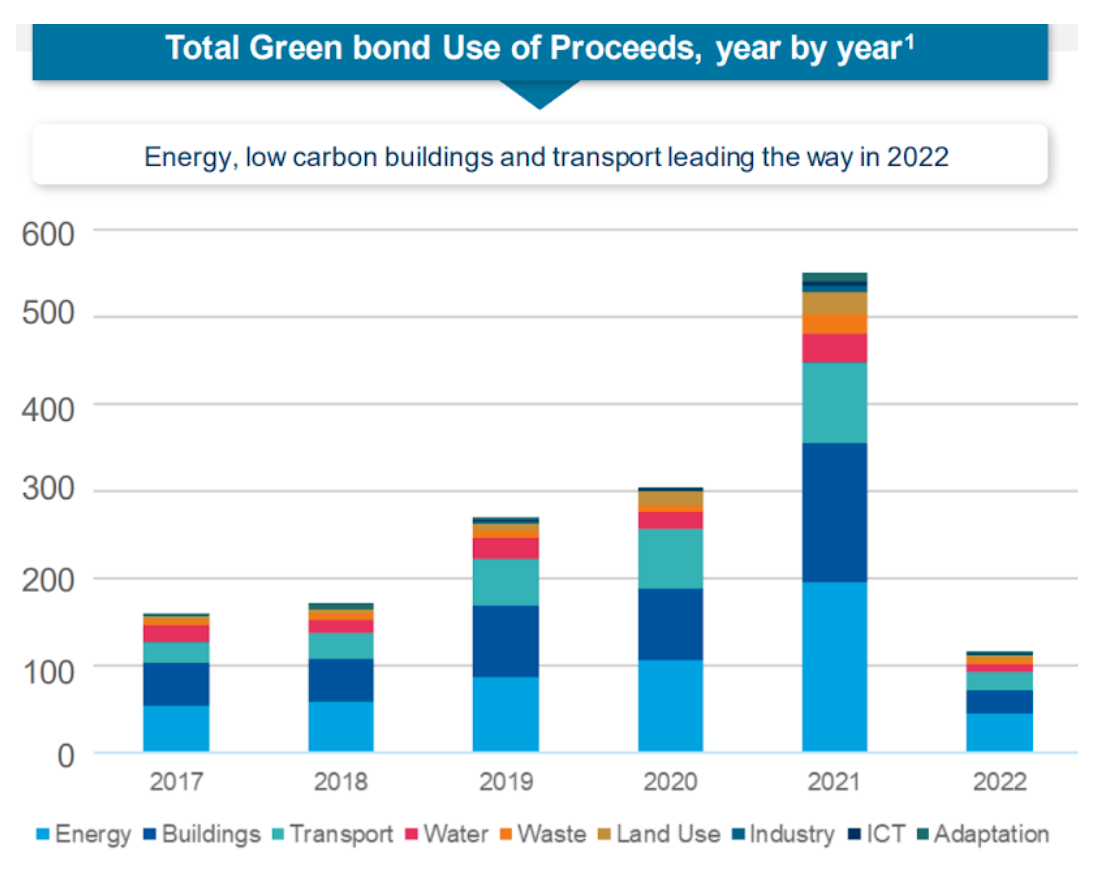

The green bond market is growing fast, with nearly US$550 billion bonds issued in 2021 alone. However, there’s still tremendous space to grow as it’s only 1% of the overall regular bond market.

1. Source: Amundi as of 12/05/2022

Typical issuers are national governments, cities, companies and supranationals (e.g., World Bank and KFW).

The government of France, for example, is well known for funding efficient railway systems through green bonds.

So when can a bond be classified as “green”?

There are three criteria normally needed for a bond to be “green”:

- The proceeds (money) received in exchange for the bond must be invested in projects meeting “green” requirements as defined by institutions like the World Bank.

- The proceeds must be traceable to ensure they truly went to green projects.

- The use of proceeds must be reported periodically, usually annually.

The benefits of green bonds

#1 Returns

Investors get from green bonds pretty much the same returns as with regular bonds, but their investment is directed to projects doing good things for the planet.

#2 Sustainability

National and local governments benefit by raising money for important projects needed to make their country and cities more sustainable.

Companies obtain funding allowing them to make their operations greener or offer more sustainable products. Plus, there’s a monetary incentive as these can be eligible for tax benefits.

Who regulates green bonds?

What may surprise you is that no official global regulation exists that defines or supervises green bonds for compliance. In essence, the standards are self-reporting.

Green bond eligibility is determined by non-profit organizations like the:

Climate Bond Initiative (CBI) or

International Capital Markets Association (ICMA).

However, they aren’t enforcers.

Debates are ongoing on whether this market should be more tightly regulated. The argument against heavier regulation is that it increases costs for bond issuers, potentially decreasing the interest of offering them.

We don’t buy that argument and support tighter regulation. This protects against greenwashing, the practice of stating or implying that a project is greener than it actually is. Besides, what’s the point of having green bonds if we can’t really know whether they are truly green!?

And what benefit do green bonds have for the planet if in the end they’re not really following green principles? Tighter regulation would go a long way in reducing these risks.

At Grünfin your climate portfolio invests in green bonds or in bonds issued by companies aligned to the Paris Agreement goal of reaching net zero emissions by 2050 to save our planet.

These could also be interesting to you

Quaterly news from Grünfin 2024 Q3

Quarterly (q3, 2024) updates about the financial markets, news, and your portfolio performance.

Quaterly news from Grünfin 2024 Q2

Quarterly updates about the financial markets, news, and your portfolio performance.

Quaterly news from Grünfin 2024 Q1

Grünfin quaterly news about financial markets and Grünfin sustainable portfolios.