At Grünfin we believe in long term investing.

After years of following and studying markets, we’ve concluded that it’s practically impossible to consistently time the market by buying at the bottom and selling at the top.

An investor may get lucky once, but doing this consistently is nearly impossible. Therefore we see more odds on our side while playing the long-term strategy.

Why consider long term investing?

Keeping a long term investment focus by staying invested throughout the ups and downs is a strategy that has worked for over 100 years.

Long term investment strategy: explained with an example

Take the most famous of the old stock indices, the Dow Jones Industrial Average.

Since its creation in 1896, it has returned a positive 7% annually. This includes having been invested through World Wars and economic depressions, but also in times of economic growth and prosperity. As you can see by the 7% return, the good times have far outweighed the bad.

Long term vs Short term investment strategy. 94% of the time long-term and passive has won.

Short term investing, on the other hand, has consistently not worked. Let’s look at actively-managed funds as proof of this.

Actively-managed means that professionals actively pick stocks and buy/sell positions based on market movements and new data.

Their aim is to provide investors with a return higher than a stock index.

In other words, they try to beat famous indices like the Nasdaq, S&P 500, DAX, Dow Jones, etc. A lot of investor money is invested in this type of funds.

Actively-managed funds are biased towards the short term. They are under a lot of pressure to beat their index given the generally high fees they charge. Meaning investors expect strong performance, be it on a monthly, quarterly or annual basis. However, almost none of these professional actively-managed funds actually beat the index they seek to outperform.

A staggering 94% of US actively-managed funds performed worse than their index in the last 20 years. And these are professionals with large teams of research analysts and massive data budgets!

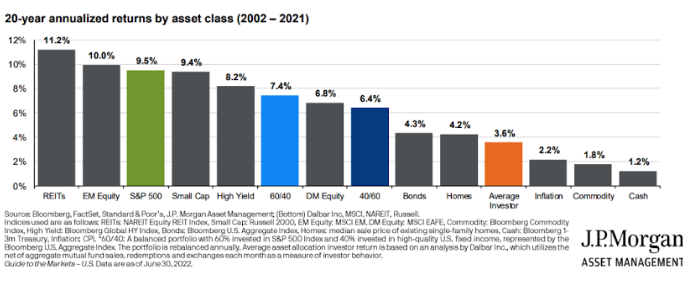

Check out this other comparison.

Over the last 20 years, the average investor obtained an annualized return of 3,6%. This is significantly below the 9,5% return of the S&P 500 stock index. This difference is massive! More details on pg 63 of this presentation prepared by J.P. Morgan.

Know the risks of your investment strategy

Market sentiment can change fast and market moves can be even faster. Trying to time the market is risky.

We admit long term investing is not as exciting as short term. By focusing on the short term, an investor is probably more involved with the markets and follows companies more closely. Surely this can be fun.

If you enjoy short term trading, by all means do it, but with a smaller amount of your wealth. To be a wise investor, the larger part of your wealth should keep a long term focus.

Our philosophy in Grünfin is to stay invested long-term, continuously invest new savings and invest sustainably!

For more details on our philosophy, see our 5 Secrets.

These could also be interesting to you

Quaterly news from Grünfin 2024 Q2

Quarterly updates about the financial markets, news, and your portfolio performance.

Quaterly news from Grünfin 2024 Q1

Grünfin quaterly news about financial markets and Grünfin sustainable portfolios.

Sustainability's highest standard. Grünfin is now a B-Corp

Certified B Corporations, or B Corps, are companies verified by B Lab, third party, to meet high standards of social and environmental performance, transparency, and accountability.