In a world where everyone is talking about sustainability and greenwashing is turning heads, it is hard to distinguish what is actually green from what is not.

That is why we need third-party organizations that help us understand who to trust: who is taking action and who is only talking and using green labels.

B-Corps are leaders in the global movement for an inclusive, equitable, and regenerative economy. Unlike other business certifications, B Lab is unique in its ability to measure a company’s entire social and environmental impact. Grünfin is now officially good!

What is a B-Corp?

To become a B Corp, companies must demonstrate how they address social inequalities and protect the environment. In addition, they need to show their organisational and leadership structures, demonstrate the working conditions of their employees, and reveal their relationships with the community.

B Corp indicates that besides profit, the company also values impact on the planet and people.

To achieve certification, a company must:

- Demonstrate high social and environmental performance by achieving a B Impact Assessment (BIA) score of 80 (out of 200) or above and passing the assessment risk review. An average company’s impact score is 50/200.

- Make a legal commitment by changing their corporate governance structure to be accountable to all stakeholders, not just shareholders, and achieve benefit corporation status if available in their jurisdiction.

- Exhibit transparency by publicly making information about their performance measured against B Lab’s standards available on their B Corp profile on B Lab’s website. See Grünfin’s info here.

(Source: B-Lab official website)

5 Impact areas that B Corp is evaluating

There are 3 fields in the classical ESG model:

- Environment,

- Social and

- Governance.

However, the B-Corp goes further, dividing “S” into workers, community, and customers. Thereby, The B Impact Assessment evaluates a company’s practices and outputs across five categories:

#1 Governance:

Governance covers the company’s overall mission, ethics, accountability, transparency, and how its values are incorporated into its bylaws.

Best practices include how companies engage employees, board members, and the community to achieve their mission, employee access to financial information, customers' opportunities to provide feedback, and the diversity of their governing bodies.

#2 Workers:

The “Workers” category refers to an organization’s efforts to create a positive work environment.

Best practices in the work environment consider aspects like employee compensation, benefits, training, and ownership opportunities, as well as working communication, job flexibility, worker health, safety practices, and overall work conditions.

#3 Community:

What a business does to contribute to the economic and social well-being of its communities.

Best practices explore initiatives and policies for community impact, including embracing supplier relations, social engagement, charitable giving, and strong, diverse communities.

#4 Environment:

An organization’s business practices that reduce its impact on the air, climate, water, land, and biodiversity to create a more sustainable and regenerative planet.

The environment section explores the environmental impact of a company’s facilities, materials, emissions, resource and energy use, transportation/distribution channels, and supply chain.

#5 Customers:

How a company serves its customers, offering products or services that support the greater good.

Best practices explore whether a company adds value to customers' lives by providing critical services like education, healthcare, and finance management and engaging in ethical marketing, data privacy and security, and feedback channels.

The impact score of Grünfin is comparable to Patagonia’s

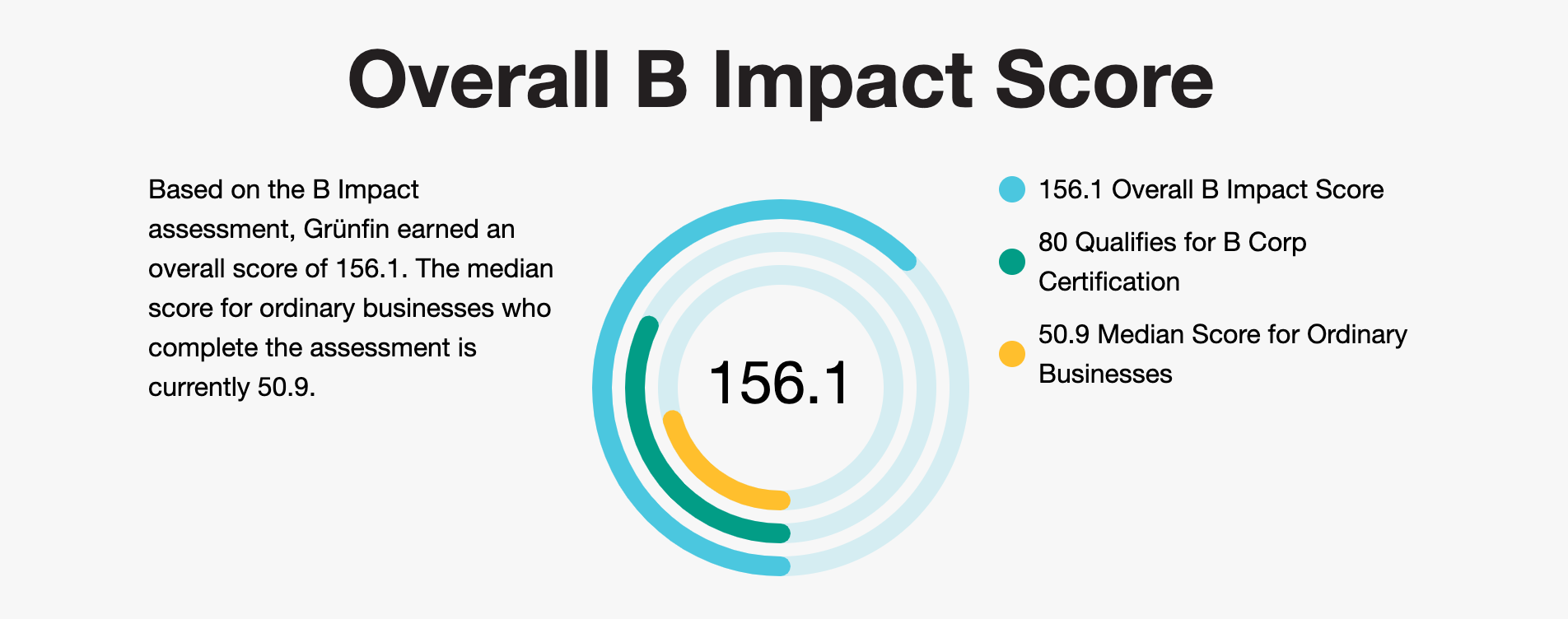

Grünfin’s B-Corp score was 156,1 out of 200. The company needs at least 80 points out of 200 to be certified as a B-corporation, but another milestone is “how to be even better.”

Just to compare, Patagonia has an impact score of 166, and some other financial services, such as Tomorrow Bank, an impact bank from Germany, have a score of 118,1.

We are proud to show excellent results on the impact of transparent governance and our investment strategy. However, we see much more we can do to improve our environmental footprint.

Why is it essential for you - as a Grünfin user, client or partner?

Because of the trust and transperancy.

As an impact company, we wish to be transparent in our actions. Our certification by the third and most reputable party in the world, assures our clients, partners, and fans the transparency about the sustainability we promise.

We understand the need for people, consumers, and business partners to be convinced of companies' social efforts and sometimes it is not easy to look behind that green label. B Corp evaluation and impact reporting make our activities transparent, mission and values clear.

By all means and third party, you get the guarantee that Grünfin is doing what we are talking about—our values include people and the planet besides the profit. And this is the business model we believe in.

Let’s B the Change together!

Well-known B-Corp companies

Some of the very well-known B-Corp Companies who care besides profit, about the planet and people are, for example:

These could also be interesting to you

Quaterly news from Grünfin 2024 Q2

Quarterly updates about the financial markets, news, and your portfolio performance.

Quaterly news from Grünfin 2024 Q1

Grünfin quaterly news about financial markets and Grünfin sustainable portfolios.

Sustainability's highest standard. Grünfin is now a B-Corp

Certified B Corporations, or B Corps, are companies verified by B Lab, third party, to meet high standards of social and environmental performance, transparency, and accountability.