Markets can quickly move up but also down. But if you’re a long-term investor, you should not be discouraged by that. Actually long-term investing has proven to be one of the most profitable and best strategies for investors.

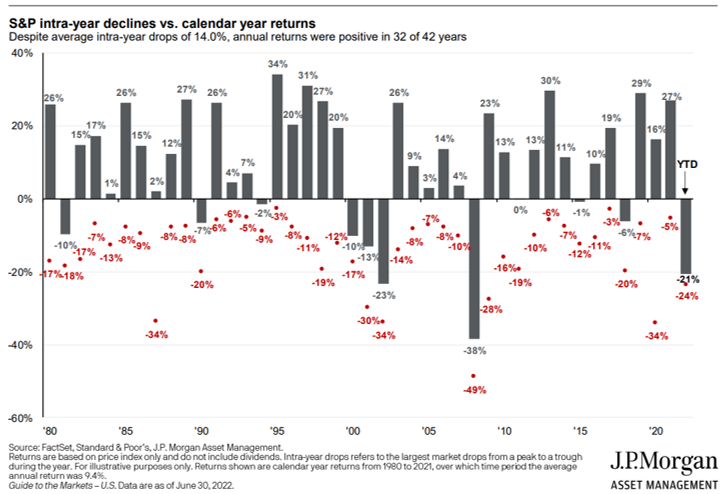

The chart below is one of the best we’ve seen for putting in perspective gains and falls.

Long term investing in statistics: analyzing the chart

Let’s look at long-term investment statistics!

- The grey bars show the calendar year return of the stock market, as measured by the S&P 500, from 1980 to 2022.

- The red dot shows the biggest decline that occurred during each of those years.

The important thing to understand: even though markets fall at some point every year, they usually recover and finish positively most calendar years. That’s been the case in 32 of the last 42 years.

Here’s a good example that is still vivid in our minds. 2020 was the year that COVID broke out and the markets responded with a substantial fall.

Looking at the chart, what was the market’s biggest fall within that year? -34%. Now, look at the return for the whole year. It was +16%!

Even though the fall was big, stocks still managed to recover all the losses and actually end the year with a very good gain.

An investment lesson for the ages – be patient.

INTERESTING FACT: Long-term investing is also one of the 5 key tenets to Grünfin’s portfolio philosophy. Read 5 secrets, why many Grünfin portfolios have outperformed several markets this year. Make sure to read all 5!

These could also be interesting to you

Quaterly news from Grünfin 2024 Q1

Grünfin quaterly news about financial markets and Grünfin sustainable portfolios.

Sustainability's highest standard. Grünfin is now a B-Corp

Certified B Corporations, or B Corps, are companies verified by B Lab, third party, to meet high standards of social and environmental performance, transparency, and accountability.

What a Difference a Year Makes (Grünfin Update & Quarterly Statement)

What happened in financial markets in 2023 and how we see 2024?