At Grünfin we’re combining investing with activism, so you feel each euro invested is truly working towards a more sustainable future.

But what exactly is investor activism?

Shareholder activism (also called activist investor) is when an investor attempts to bring about change in a publicly-traded company. This could happen through many ways like:

- engaging with the company’s upper management,

- taking board seats,

- going to the press and participating in shareholder meetings by voting on proposals or raising provocative questions.

Shareholder activism examples: good and bad causes

Good causes of investor activism

Using activism, some investors may push an oil company to move towards renewable energy like solar and wind production.

Another investor may demand better employee working conditions at factories. Others may call for a fairer promotion process for women and minorities. We consider these good examples of activism.

Bad causes from investor activism

There’s also the bad kind, usually associated with short-term greed and ruthlessness.

Such investors will buy large amounts of a company’s stock to obtain enough voting rights to force key decisions, such as

- laying off employees to cut costs,

- maximizing short-term sales,

- squeezing suppliers, etc.

Their goal is for the company’s stock to rise quickly to create gains for themselves, regardless of the long-term consequences.

At Grünfin, rest assured we exercise the good kind of activism.

What is Grünfin’s goal with investor activism?

Grünfin’s goal is to secure a better treatment of the planet and its people by combining investing with long-term activism.

We aim to influence the sustainability agendas of the world’s largest companies, whose reach touches every corner of Earth.

Is sustainability a real trend?

Yes. We have proof here:

- Nearly 200 countries ratified the Paris Climate Agreement whose main goal is to achieve net-zero carbon emissions by 2050 to limit global warming and save the planet.

- Individuals are now 4x more likely to buy from companies with a strong purpose.

- Roughly 400 of the world’s largest publicly listed companies, with $14 trillion in combined sales, have committed to net-zero targets.

- Sustainable investing in funds has grown 5x over the last 5 years.

- 90% of professional investors expect their firm’s commitment to sustainability to increase over the next decade.

How does sustainability translate to strong investment performance?

Companies embracing sustainable practices should do well financially in the long-term, leading to better stock performance.

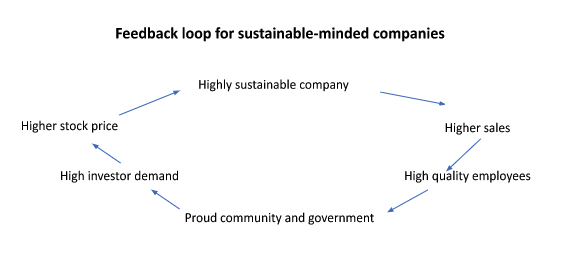

Think of a positive feedback loop. Consumers are increasingly demanding sustainable products, so they will buy from sustainably-minded companies. People will be proud to work for them, so these companies will have high-quality employees.

Communities will support them. Governments will view them as key and responsible partners. Investors will see more value in them and increase the demand for its stock, in turn leading to a higher valuation and better stock performance. All while doing good things for the planet and its people!

5 concrete examples of Grünfin’s activism.

#1 Call to Credit Suisse

We publicly called on Credit Suisse, the Swiss banking giant, to immediately and significantly reduce its financing of oil & gas companies.

Here’s the Reuters article mentioning this initiative and Grünfin’s participation.

#2 Nestle, Danone, Kellogg and Kraft Heinz for healthier foods

We signed letters directed to the Chair of the board, the most powerful position in a company, of each of these (Nestle, Danone, Kellogg and Kraft Heinz) urging them to offer healthier foods to tackle obesity, which affects 650 million people worldwide.

Given the global reach of these corporations, they have a tremendous responsibility for what they feed all of us.

#3 Unilever sustainability commitments

We met with Unilever’s Chief R&D Officer of Nutrition to follow up on their commitment to better disclose the healthiness of their food products and set targets for increasing their share of healthy foods sales.

Unilever continues driving to deliver on such commitments. Every day 2,5 billion people across 190 countries consume Unilever’s products.

#4 Deutsche Bank and Oil Pipeline in Africa

At the German banking giant’s annual shareholder meeting, we asked about its plans to finance the longest heated crude oil pipeline in the world, which will stretch for 1.444 km from Uganda to Tanzania.

Anonymous sources say Deutsche Bank will abandon this project, but we haven’t yet heard this from their management team. We will continue pressuring.

#5 PepsiCo and Healthiness

We met with Pepsi’s senior management regarding the healthiness of their products. This was our first meeting and quite constructive, so more to come.

How do we get access to such large and global companies?

We teamed up with ShareAction, a UK-based non-profit that leads coalitions of investors. Read more about our partnership here.

These could also be interesting to you

Quaterly news from Grünfin 2024 Q3

Quarterly (q3, 2024) updates about the financial markets, news, and your portfolio performance.

Quaterly news from Grünfin 2024 Q2

Quarterly updates about the financial markets, news, and your portfolio performance.

Quaterly news from Grünfin 2024 Q1

Grünfin quaterly news about financial markets and Grünfin sustainable portfolios.