Invest in the world’s most impactful funds through an investment portfolio tailored to your values.

A future-focused portfolio. In a time of low-carbon economy transition and purpose-driven businesses, investing sustainably is a long-term winning strategy.

Read moreExpert selection of funds. Using more than twenty factors, our investment team screens 300,000 funds for low-cost, high-performing funds (ETFs) that deliver true impact.

Read moreGiving your money a voice. Helping your money have an impact is our top priority. We engage with large companies in our portfolios to drive them towards positive change.

Read more

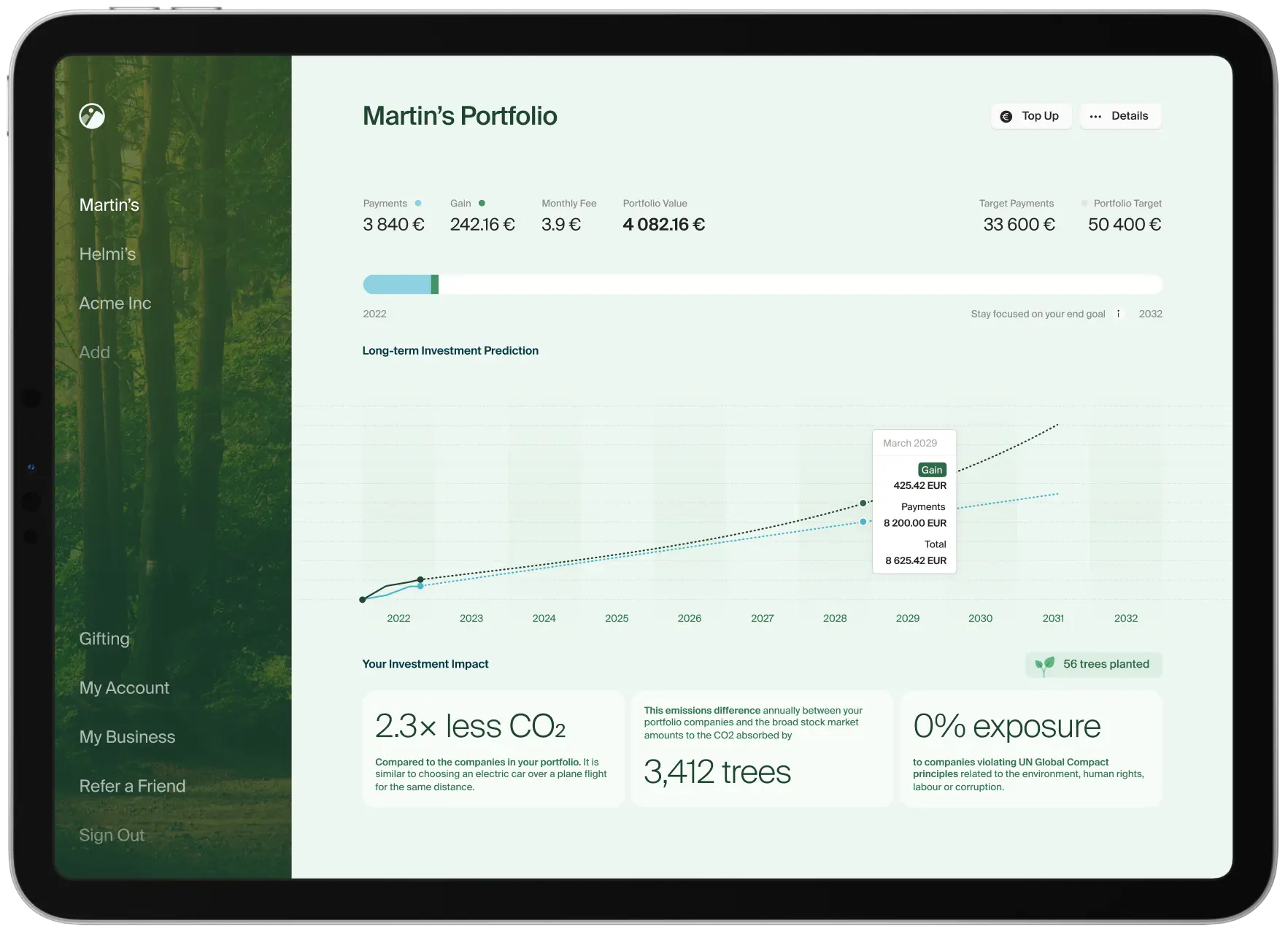

We help you see the impact of your investments

You know exactly what you're investing in.

How we invest

Your investments benefit the planet and society along with providing financial returns.

Your funds are ranked highest by independent sustainability ratings providers.

We engage with large, global companies to take actions that represent your values.

We invest for the long term and through low-cost funds.

Sustainable investing has grown 4× in the last 5 years.

Global sustainable fund assets

We push corporate change via Shareholder Activism.

Through our partnership with ShareAction, we combine impact investing with activism.

How? We engage with some of the world's largest companies to influence their sustainability agenda.

Read more about what shareholder activism is and how we together change the companies into sustainability. →

Graph source: Morningstar Direct Global Sustainable Fund Flows reports. Morningstar's global sustainable fund universe encompasses open-end and exchange-traded funds that, by prospectus or other regulatory filings, claim to focus on sustainability, impact or ESG factors. Note: All yearly figures as of Q4, except 2022 which is as of Q3.

Pricing

Simple service fee of 0.7% portfolio value / year. Covers everything!

For a 1000 € portfolio this amounts to 0.58 € per month.

No additional or hidden fees!

We are licensed and operating EU-wide. Now accessible for more than 447 million people. We are offering the services under law of The Markets in Financial Instruments Directive 2014/65/EU (MiFID II).

Frequently Asked Questions

Is my money safe in Grünfin?

Is my money safe in Grünfin?

At Grünfin, the safekeeping of your assets is our top priority.

We are regulated as an investment firm by the Estonian Financial Supervision and Resolution Authority. The license allows us to provide securities portfolio management services for clients and securities custody and management services as an ancillary service, and to provide related activities in the European Economic Area.

Your investments are protected by the Investor Compensation Scheme for up to 20 000 EUR.

Your funds are always kept separate from our company's assets, providing an additional layer of security.

Most importantly, the assets in your Grünfin portfolio are always yours. You have the freedom to sell your investments and withdraw your money whenever you need to.

Read more →

Where does Grünfin invest my funds?

Where does Grünfin invest my funds?

We set up a personalised Grünfin portfolio based on your values and financial goals. Our team of experts carefully selects sustainable exchange-traded funds (ETFs) to your portfolio, considering the larger impact on people and the planet.

We screen, analyse and rate the best sustainable funds worldwide to build your portfolio without preferring any single service provider, so you can earn market-based returns while making a positive impact on the world.

Your portfolio is highly diversified not just within industries, but also across countries and, exposed to many large, global companies ranking highly in sustainability matters.

We actively monitor the market and review our selection of sustainable ETFs on quarterly basis. If there are new and better sustainable ETFs available that meet our sophisticated criteria, we can add them to Grünfin portfolios or make replacements over time.

Read more →

What returns can I expect from sustainable investments?

What returns can I expect from sustainable investments?

One of the main concerns for investors is if they’re sacrificing profit for sustainability.

The answer is no. The performance of sustainable investment funds is similar conventional funds.

Sustainable investing is a way of future-investing and in a number of reports, sustainable funds also show better historical performance.

Moreover, we strongly believe that sustainable companies are well-positioned for long-term success due to lower risks, increasing customer demand, and innovative solutions.

Read more →