Researches show

How are the employees in your company feeling?

Why consider an employer investment plan?

A new, attractive way to save on your recruitment costs. An investment plan is an excellent alternative to an options plan for keeping talents in the company.

Financial security = less stress + more productivity. ca 2/3 of the employees feel financial stress that can harm productivity. Growing investments grow financial safety as well as productivity.

You are presumed to be a caring and value-based employer. New talents are driven by mission, sustainability, and investment options.

Investment plan opportunities

Investment principles. We invest in companies who

- 1

Have joined The Paris Agreement

- 2

Reduce CO2 footprint by 7% yearly

- 3

Has at least a 50% smaller CO2 footprint than the average financial market

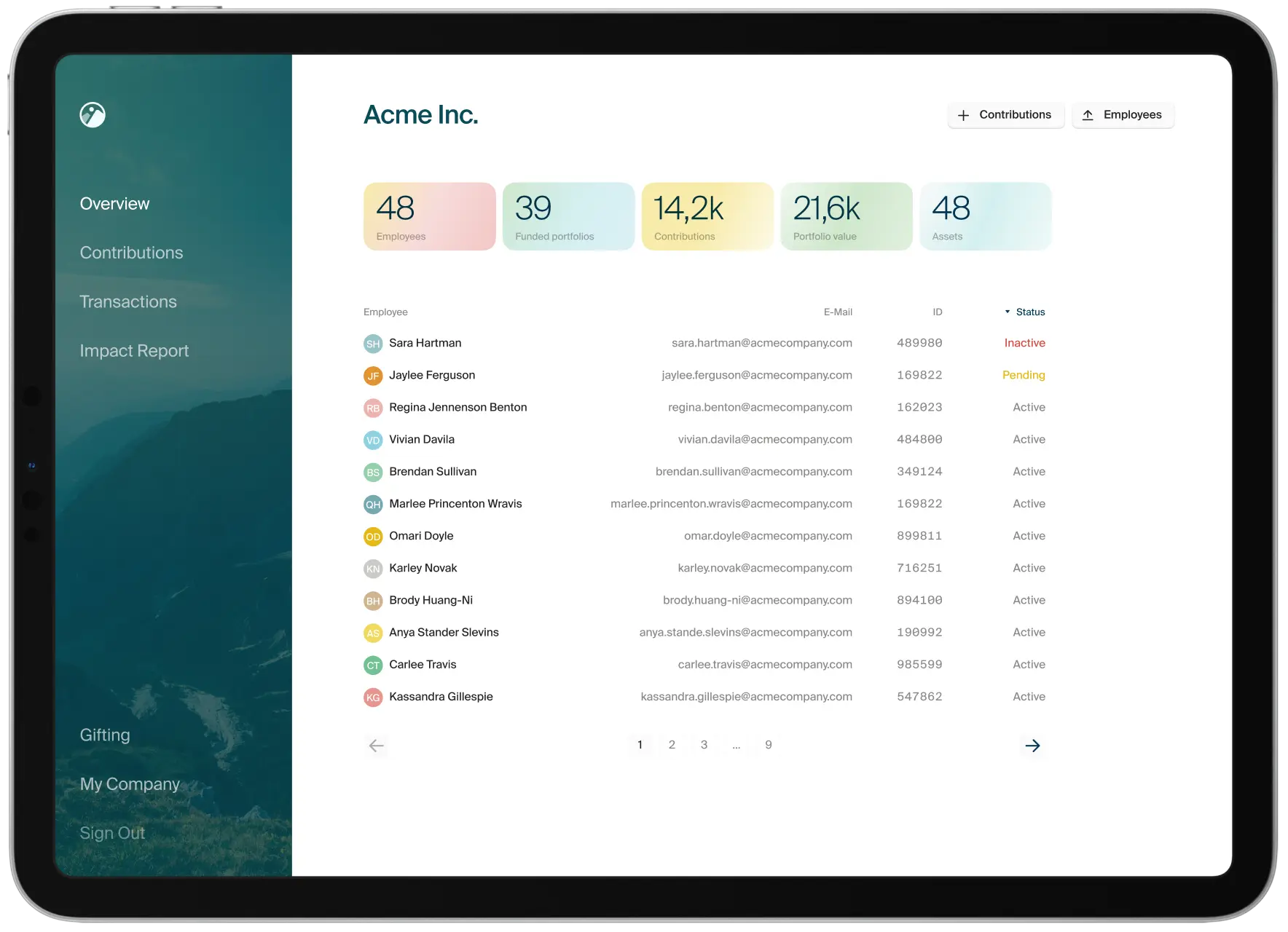

Employer dashboard.

Easy, platform-based management.

It takes 15-30 min/per month for HR and accounting team to handle it.

Employee dashboard.

See how your money grows — educative content and reports.

If we want people around us to contribute to a new generation, we must be a role model for that.

Martin Vares

CEO & Co-founder at Fractory

Questions about how the investment plan works or wish to join us?

Leave us your info, and we will agree on the meeting to answer all the questions.

Frequently Asked Questions

As an employer, do I need to know everything about investing?

As an employer, do I need to know everything about investing?

No, you don't need to be an investment expert yourself.

We have a highly experienced team that does all the hard work for you. We'll find the best ETFs with both, returns and impact.

We encourage awareness through our channels and newsletters.

Is the investment plan easy to manage?

Is the investment plan easy to manage?

Yes. As an employer, you'll have an overview of the employees who have joined the investment plan and the transfers made to the portfolios.

Our experience shows that administration takes about 15-30 minutes per month.

Do I need to enroll all my employees to join the investment plan?

Do I need to enroll all my employees to join the investment plan?

As an employer, you have the opportunity to give your team freedom of choice and enroll exactly the employees who want to be included.

For example, you can offer an investment plan as an alternative to a sports benefit. Around 40% of employees don't want to use the sports allowance, and for some it will expire - but it would probably be nicer if the money would grow for the employee.

Or would you like to reward your key employees? You can use the investment plan to boost their motivation.